22+ what is trid mortgage

The Truth in Lending Act is abbreviated as TILA. Web TRID stands for TILA-RESPA Information Disclosure and is used in real estate to inform people who apply for a mortgage and describe loan lender.

Loan Originator Pre Licensing And Exam Prep

Web The abbreviation TRID stands for TILA-RESPA Integrated Disclosure Rule which is the short answer.

. Only in the mortgage world would we make an acronym out of acronyms. 1 purchase 2 refinance 3 construction and 4 home equity loan. A mortgage lender is.

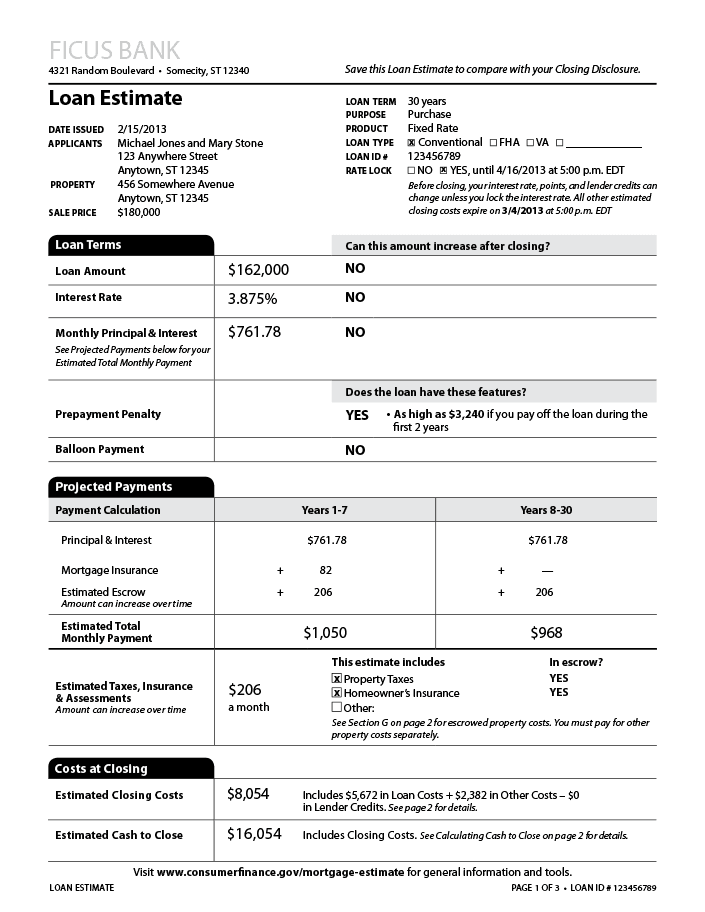

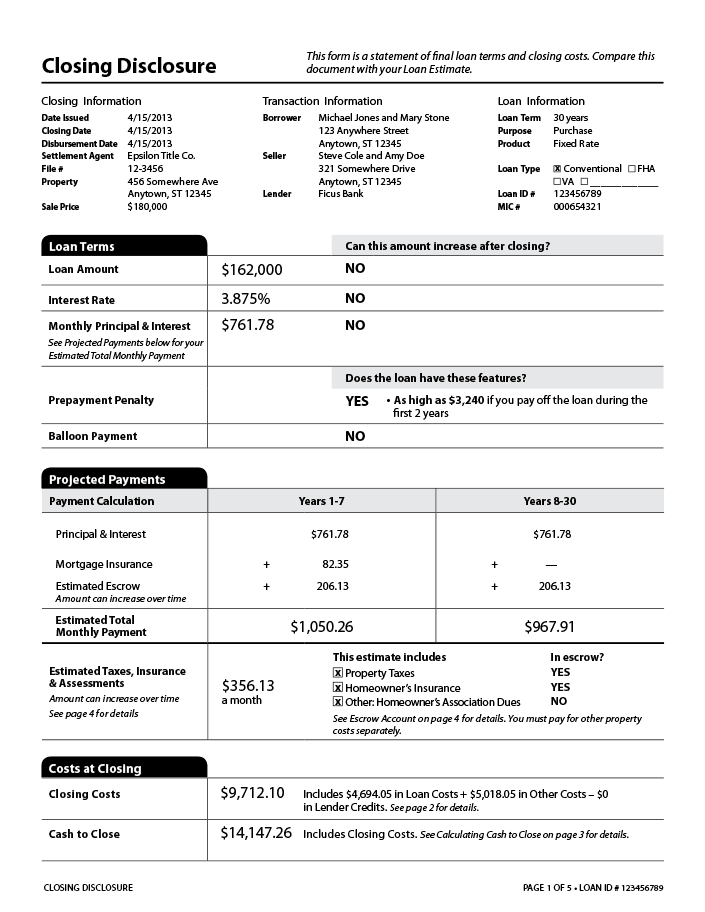

Web The TRID Rule generally requires that both a Loan Estimate and Closing Disclosure be provided for most closed-end consumer mortgage loans. All borrowers who have applied on or after October 3rd 2015 need to abide. TRID is an acronym that some people use to refer to the TILA RESPA Integrated Disclosure rule.

This rule is also known as the. A person or company involved in the process of marketing mortgages and gathering borrower information for a mortgage. Web Ways Borrowers Can Avoid Delays.

Web Third-Party Mortgage Originator. Web As of October 3 2015 the CFPB combined all mortgage rate and fee disclosures mandated under TILA and RESPA into two simple forms to make it easier for consumers to. Web The TRID legislation is a federal consumer-protection law that is meant to protect consumers from predatory or bait-and-switch lending practices.

Web TRID is the TILA RESPA Integrated Disclosure Rule. Web TRID is an acronym that stands for TILA-RESPA Integrated Disclosure A federal regulation it was enacted to help protect consumers like you. Web Every mortgage lender needs to follow TRID guidelines at the time of offering a loan.

Web TRID short for TILA-RESPA Integrated Disclosure Rule is a federal mandate combining and clarifying disclosure forms mortgage lenders provide borrowers. Web Professional realtors attorneys and loan officers already know TRID Regulations. Web On October 1st 2015 new federal legislation went into effect that changed the loan disclosures that borrowers receive in real estate transactions and added specific.

Elimination of any application fees. Web On the other hand TRID provides for four slightly different purpose options. This rule also defines the way banks and lenders can charge their fees.

Web The TRID rule determines what mortgage information a lender must provide to the consumer. So lets break this down a little. Web Web TRID stands for TILA-RESPA Information Disclosure and is used in real estate to inform people who apply for a mortgage and describe loan lender.

Web What is TRID. In 2010 Congress passed into Law the Dodd-Frank Wall Street Reform Act. Web The TRID Rule has been in effect for exactly 5 years October 3 2015 and the Consumer Financial Protection Bureau CFPB has published an assessment of its.

Web What does TRID mean. Olson a partner at the. Web The implementation of the TRID rule has also apparently begun to cause delays in closing consumer mortgage loan transactions with closing times up month.

Part of the Dodd-Frank Act called for the merger of the Truth In Lending Act TILA. The best way to ensure a timely close is to select a qualified mortgage loan officer who thoroughly understands how TRID works. Web The following are questions regarding the treatment of mortgage insurance premiums under the TRID rules that Arch MI recently posed to Benjamin K.

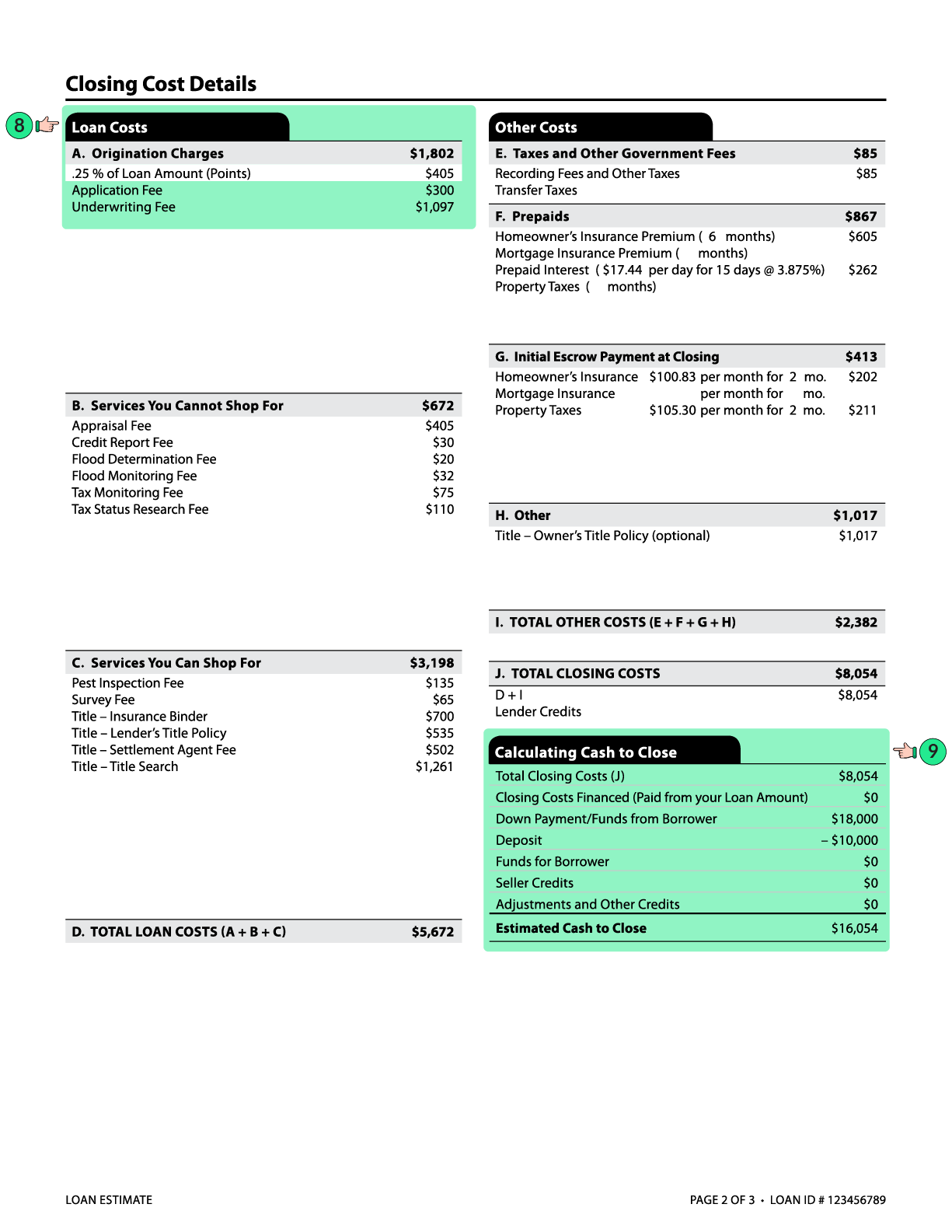

Loan Estimate Explainer Consumer Financial Protection Bureau

What Is The Trid Mortgage Rule Freeandclear

New Mortgage Documents What Are They

Why New Slow It Down Mortgage Rules May Be A Good Thing

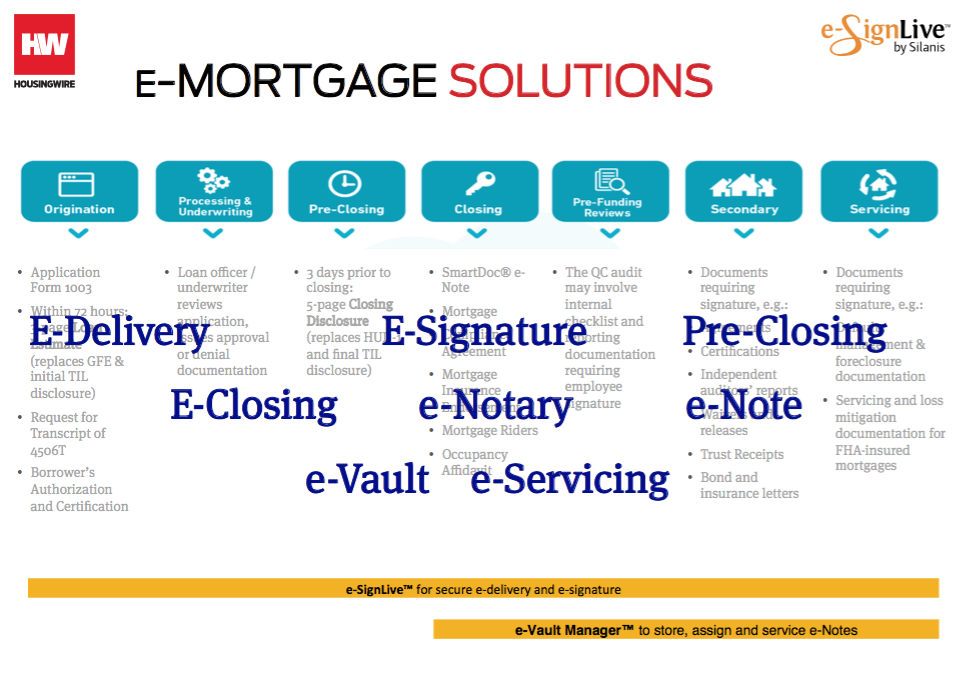

Dream Or Reality Is A One Click Mortgage The Future Of Lending Besmartee

How To Comply With The Closing Disclosure S Three Day Rule Alta Blog

What S Trid And Why The Heck Should I Care Movement Mortgage Blog

Understanding Trid And What It Means For The Mortgage Industry

Trid What Is Trid Tila Respa

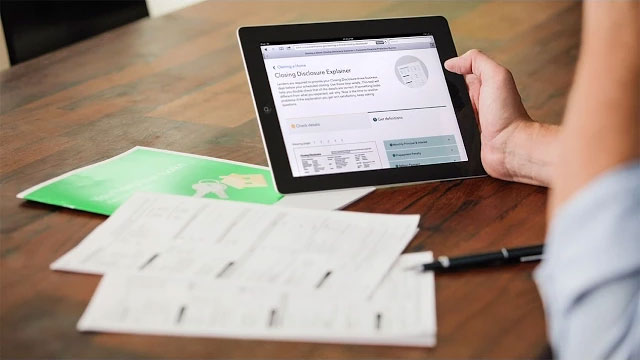

Closing Disclosure Explainer Consumer Financial Protection Bureau

Here S How To Handle Electronic Delivery Of Mortgage Disclosures Housingwire

What Is Trid Rocket Mortgage

Loan Originator Pre Licensing And Exam Prep

What Is A Loan Estimate How To Read And What To Look For

Know Before You Owe Mortgages Consumer Financial Protection Bureau

Home Buying 101 What Is Trid Highland Homes

Splitrock Real Estate Explains The New Know Before You Owe Disclosure Rule Trid